Due to the multiple IRR problem and the unrealistic reinvestment rate assumption inherent in IRR methodology, net present value is the preferred capital budgeting tool. Small changes in the discount rate can significantly impact the present value, making it challenging to accurately compare investments with varying levels of risk or uncertainty. Regardless of this, capital budgeting relies heavily on just a few basic principles.

- In the case of Shania and her magazine, she might decide to move from print to digital, drastically reducing operational costs.

- You must take into account the timing and size of the initial negative outflow and the positive ones to come after.

- One of the main challenges of capital budgeting is to evaluate and compare different projects with different cash flow patterns.

Step 3: Calculating the IRR

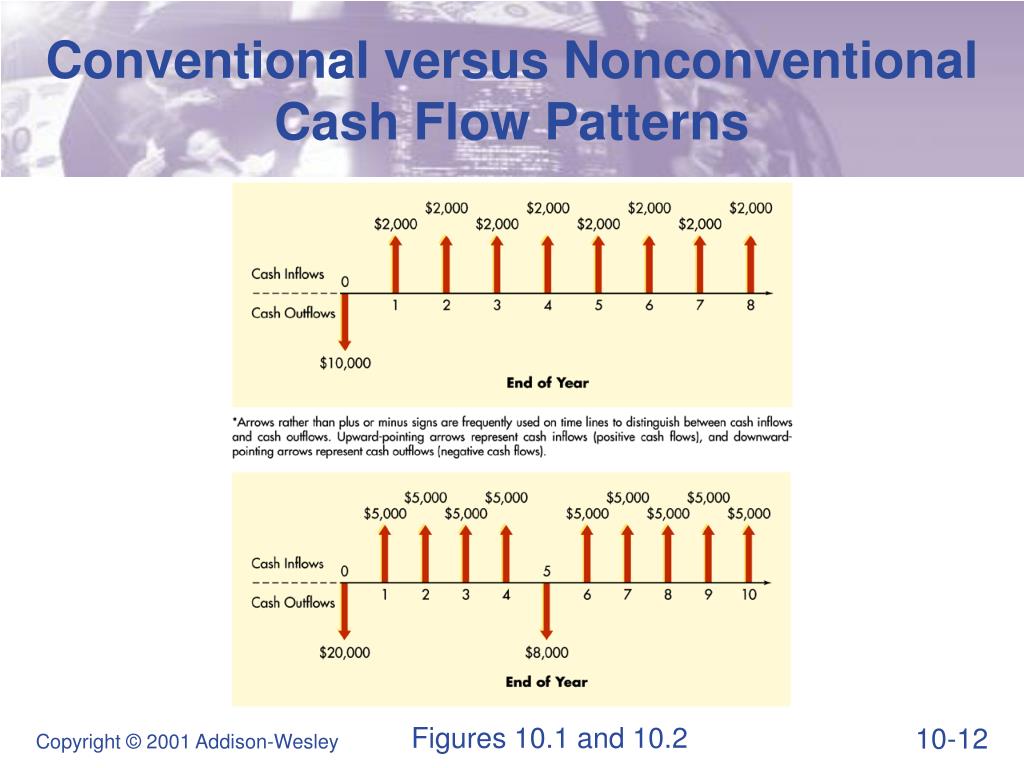

Conversely, unconventional cash flows involve more than one change in cash flow direction and result in two rates of returns at different intervals. One of the main challenges of capital budgeting is to evaluate and compare different projects with different cash flow patterns. A cash flow pattern is the sequence of cash inflows and outflows over the life of a project. A conventional cash flow is one that has an initial cash outflow (investment) followed by a series of cash inflows (returns). A non-conventional cash flow is one that has multiple changes in the sign of the cash flows, such as a project that requires additional investments or has intermediate cash outflows.

Cash Flows From Operations (CFO)

Capital budgeting and investment decision-making are essential for any organization’s financial landscape. Companies assess potential investments with tools like net present value (NPV), internal rate of return (IRR), payback period, and accounting rate of return. Assume that a homeowner has taken mortgage amounting to $300,000 to be repaid at a fixed interest rate of 5% for 30 years.

Capital Budgeting Concepts

Send invoices, get paid, track expenses, pay your team, and balance your books with our financial management software. Cash flow statements have been required by the Financial Accounting Standards Board (FASB) since 1987. Cash flow refers to the amount of money moving into and out of a company, while revenue represents the income the company earns on the sales of its products and services. Another example can be seen in people’s daily lives, such as the simple process of withdrawing money from an account to pay monthly expenses. A person who keeps a careful list of monthly expenses knows precisely how much he or she needs to withdraw from the bank.

If the IRR is greater than the hurdle rate, the project is accepted, otherwise it is rejected. When there are more than two IRRs, it is not exactly clear which IRR to compare with the hurdle rate. Multiple IRRs occur when a project has more than one internal rate of return. The problem arises where a project has non-normal cash flow (non-conventional cash flow pattern). Present Value is a fundamental concept in finance that enables investors and financial managers to assess and compare different investments, projects, and cash flows based on their current worth.

Despite high revenue figures, they suffered from liquidity issues due to slow-paying customers and excessive debt servicing costs. But after applying cash flow analysis techniques, they gained important insights into their working capital requirements and devised strategies for better financial management. This enabled to change without 2020 them to maximize resources and grow both revenues and profits. Furthering one’s financial analysis skills is done by calculating various ratios like the operating cash flow ratio or free cash flow margin. Comparing different companies in an industry or tracking an individual company’s performance over time is possible.

The aim is to make sure the project will bring back the initial investment and some profit on top. In practice, most investments deviate from the CCF model as they involve ongoing expenses such as raw materials, maintenance, and additional capital outlays. CCFs play a pivotal role in decision-making for companies facing choices between diverse projects. Moreover, the IRR for CCFs should surpass the hurdle rate, representing the minimum acceptable return, making them indispensable for businesses seeking the most profitable investments.

Proceeds from issuing long-term debt, debt repayments, and dividends paid out are accounted for in the cash flow from financing activities section. Cash flow from investing (CFI) or investing cash flow reports how much cash has been generated or spent from various investment-related activities in a specific period. Investing activities include purchases of speculative assets, investments in securities, or sales of securities or assets. By providing a clear view of cash movements, it encourages accountability and reduces chances of fraudulent activities. It’s not random or inconsistent – it follows a path with set intervals, which makes it easier to plan and evaluate the financial success of the project.