In the dynamic landscape of startup finance, the adoption of a cost-indexing method stands as a… Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

Why You Can Trust Finance Strategists

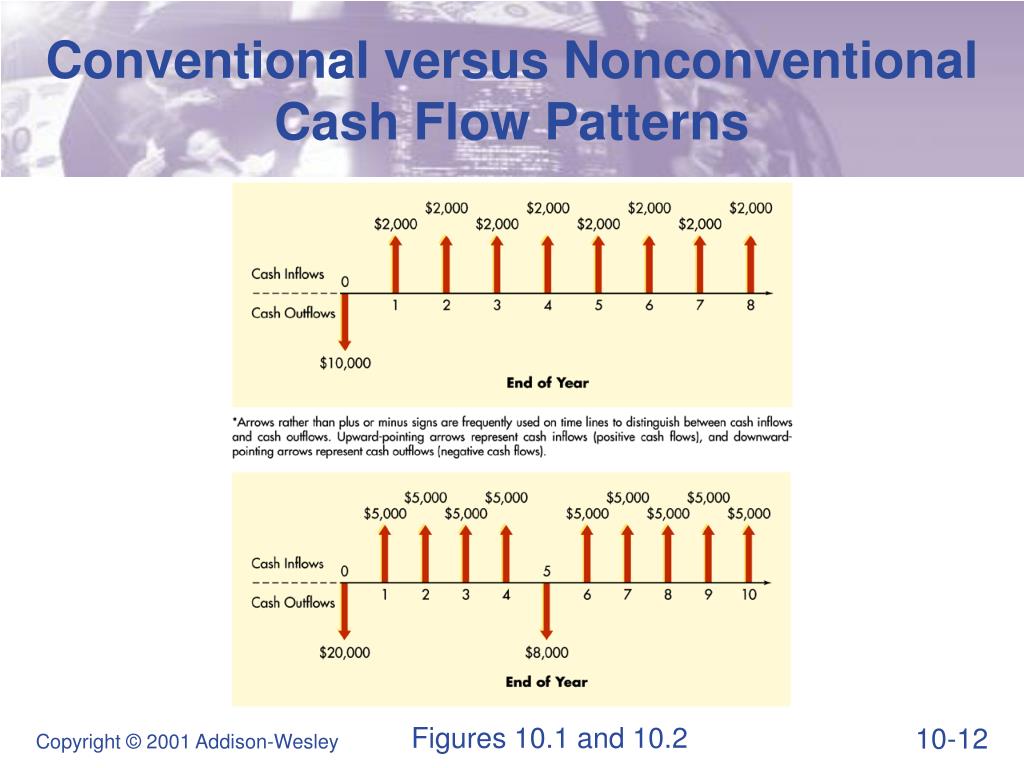

For example, a project with non-conventional cash flow may have multiple or no IRRs, making it hard to determine its acceptability and ranking. Similarly, a project with non-conventional cash flow may have multiple or no payback periods, making it hard to assess its liquidity and risk. NPV helps determine the value of a series of future cash flows in today’s dollars and compare those values to the return of an alternative investment. The return from a project’s conventional cash flows over time, for example, should exceed the company’s hurdle rate or minimum rate of return needed to be profitable.

Conventional vs. Unconventional Cash Flows

Simply computing a project’s NPV and IRR to determine which of several projects to undertake is not always as straightforward. The IRR and NPV can produce different ranking outcomes whenever mutually exclusive take advantage of these 15 commonly missed tax deductions projects are involved. Once the cash flow values have been fed into the calculator, you are ready to calculate the IRR. For example, assume Company Z wants to open a new branch office in a major city.

Understanding an Unconventional Cash Flow

- PV is a significant concept in finance, as it helps individuals and businesses to make investment decisions by estimating the current value of future cash flows.

- The price-to-cash flow (P/CF) ratio compares a stock’s price to its operating cash flow per share.

- A project with a conventional cash flow starts with a negative cash flow (investment period), where there is only one outflow of cash, the initial investment.

- The PI is the ratio of the present value of the cash inflows to the present value of the cash outflows.

It allows businesses to gain a better understanding of their financial position and steer operations towards success. Careful analysis of factors like market conditions, potential risks, and projected returns is needed to make informed decisions that align with growth plans. Capital budgeting helps businesses allocate resources more efficiently and maximize shareholder value.

Would you prefer to work with a financial professional remotely or in-person?

It helps the company choose the best and most profitable investment among the given alternatives. Conventional cash flows (CCFs) mirror the traditional investment pattern where businesses make an initial investment and subsequently generate income. This CCF concept is driven by the desire for a single initial cash outflow followed by consistent inflows. If we refer back to our example of the manufacturer, let’s say there was an initial outlay to buy a piece of equipment followed by positive cash flows. However, in Year Five, another outlay of cash will be needed for upgrades to the equipment, followed by another series of positive cash flows generated. An IRR or rate of return will need to be calculated for the first five years and another IRR for the second period of cash flows following the second outlay of cash.

There may be an initial cash inflow if the project is funded with capital borrowed from a bank or other financial institution. PV is a significant concept in finance, as it helps individuals and businesses to make investment decisions by estimating the current value of future cash flows. By calculating the PV of potential investments, investors can determine if an investment is worth pursuing or if they would be better off pursuing alternative investment opportunities.

A company is considering investing in a new machine that costs $100,000 and has a useful life of 5 years. Easier to compare different projects with similar or different scales and durations. For conventional cash flows, the NPV, the IRR, the PI, and the PP can be used as reliable criteria to rank and select the best projects.

Individuals often withdraw money from their accounts to cater for monthly expenses. If one maintains a record of his monthly expenses, then he will know exactly how much he should withdraw. Most people end up withdrawing more than they need and then depositing back the surplus amount they are left with. For independent, conventional projects, the decision rules for the NPV and IRR will both draw the same conclusion on whether to invest or not. However, in the case of two mutually exclusive projects, the decision rules will sometimes draw different conclusions.